How Livestock Risk Security (LRP) Insurance Policy Can Safeguard Your Livestock Investment

In the world of livestock financial investments, mitigating dangers is paramount to making certain monetary security and development. Animals Threat Security (LRP) insurance policy stands as a dependable guard against the unpredictable nature of the marketplace, offering a calculated strategy to protecting your possessions. By delving into the ins and outs of LRP insurance coverage and its multifaceted benefits, livestock manufacturers can fortify their financial investments with a layer of security that transcends market changes. As we check out the world of LRP insurance, its duty in safeguarding livestock investments comes to be significantly noticeable, assuring a path towards lasting monetary durability in an unstable sector.

Comprehending Livestock Risk Protection (LRP) Insurance Policy

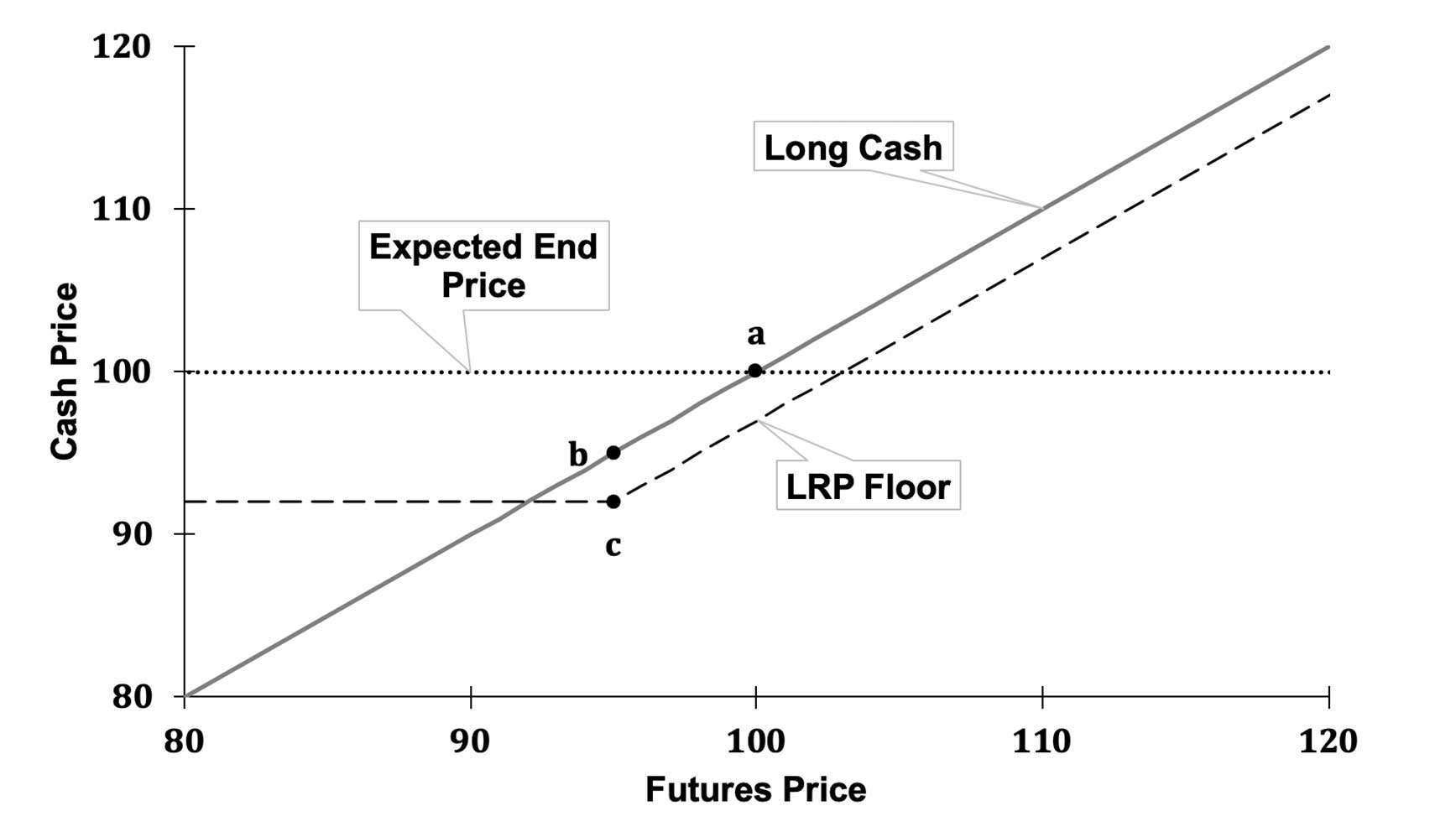

Recognizing Livestock Risk Security (LRP) Insurance is vital for livestock manufacturers aiming to minimize financial risks connected with price fluctuations. LRP is a government subsidized insurance policy item made to shield manufacturers versus a decrease in market value. By giving coverage for market price decreases, LRP aids producers lock in a flooring rate for their livestock, guaranteeing a minimal degree of revenue no matter of market changes.

One secret facet of LRP is its flexibility, enabling producers to customize insurance coverage degrees and plan lengths to fit their particular needs. Producers can choose the number of head, weight variety, coverage rate, and protection period that align with their manufacturing objectives and take the chance of resistance. Recognizing these adjustable options is important for manufacturers to effectively handle their price danger exposure.

In Addition, LRP is offered for numerous animals kinds, consisting of cattle, swine, and lamb, making it a flexible danger management device for livestock producers across different industries. Bagley Risk Management. By familiarizing themselves with the intricacies of LRP, producers can make educated decisions to protect their investments and make sure monetary stability in the face of market unpredictabilities

Advantages of LRP Insurance for Animals Producers

Animals producers leveraging Animals Danger Defense (LRP) Insurance acquire a strategic advantage in shielding their investments from price volatility and protecting a stable financial ground in the middle of market unpredictabilities. One essential advantage of LRP Insurance policy is cost defense. By setting a floor on the cost of their animals, producers can minimize the risk of considerable monetary losses in case of market declines. This enables them to plan their spending plans better and make notified decisions concerning their operations without the consistent fear of cost fluctuations.

Additionally, LRP Insurance policy provides producers with comfort. Recognizing that their investments are protected versus unanticipated market changes permits producers to concentrate on other elements of their organization, such as improving pet health and welfare or enhancing manufacturing processes. This assurance can result in enhanced efficiency and earnings in the long run, as manufacturers can operate with even helpful hints more self-confidence and stability. On the whole, the advantages of LRP Insurance policy for livestock producers are significant, providing a useful tool for handling danger and making certain economic security in an unforeseeable market atmosphere.

Just How LRP Insurance Coverage Mitigates Market Threats

Minimizing market risks, Livestock Danger Protection (LRP) Insurance policy offers animals producers with a dependable guard versus price volatility and financial uncertainties. By supplying defense versus unexpected cost decreases, LRP Insurance policy helps producers protect their financial investments and maintain economic security despite market fluctuations. This sort of insurance permits livestock manufacturers to secure a rate for their pets at the beginning of the policy duration, making certain a minimal cost level no matter market changes.

Steps to Secure Your Animals Financial Investment With LRP

In the world of agricultural risk monitoring, implementing Animals Threat Security (LRP) Insurance includes a critical procedure to safeguard financial investments versus Visit Your URL market changes and unpredictabilities. To safeguard your animals financial investment effectively with LRP, the initial step is to evaluate the details dangers your operation faces, such as price volatility or unexpected climate events. Next off, it is important to research and choose a respectable insurance policy provider that supplies LRP policies customized to your animals and organization requirements.

Long-Term Financial Safety With LRP Insurance

Ensuring enduring monetary stability through the use of Animals Risk Protection (LRP) Insurance is a sensible long-term technique for farming producers. By incorporating LRP Insurance right into their threat administration plans, farmers can safeguard their livestock financial investments versus unanticipated market variations and unfavorable events that can jeopardize their financial well-being with time.

One secret benefit of LRP Insurance policy for long-term financial security is the assurance it provides. With a reliable insurance plan in place, farmers can minimize the monetary dangers connected with volatile market conditions and unanticipated losses as a result of aspects such as illness episodes or natural calamities - Bagley Risk Management. This stability permits manufacturers to concentrate on the everyday operations of their livestock organization without continuous stress over prospective monetary setbacks

In Addition, LRP Insurance policy provides a structured approach to managing risk over the long-term. By establishing specific protection degrees and choosing ideal endorsement periods, farmers can customize their insurance plans to align with their monetary goals and run the risk of resistance, making certain a lasting and protected future for their animals see this site operations. In verdict, purchasing LRP Insurance policy is a positive method for agricultural manufacturers to accomplish long lasting economic safety and safeguard their incomes.

Verdict

In conclusion, Livestock Danger Security (LRP) Insurance is a beneficial device for animals manufacturers to mitigate market threats and safeguard their investments. It is a wise choice for safeguarding animals financial investments.