Some Of Paul B Insurance Medicare Explained

Table of ContentsPaul B Insurance Medicare Explained Can Be Fun For EveryoneSome Known Details About Paul B Insurance Medicare Explained The smart Trick of Paul B Insurance Medicare Explained That Nobody is Talking AboutGet This Report about Paul B Insurance Medicare Explained7 Simple Techniques For Paul B Insurance Medicare ExplainedIndicators on Paul B Insurance Medicare Explained You Need To Know

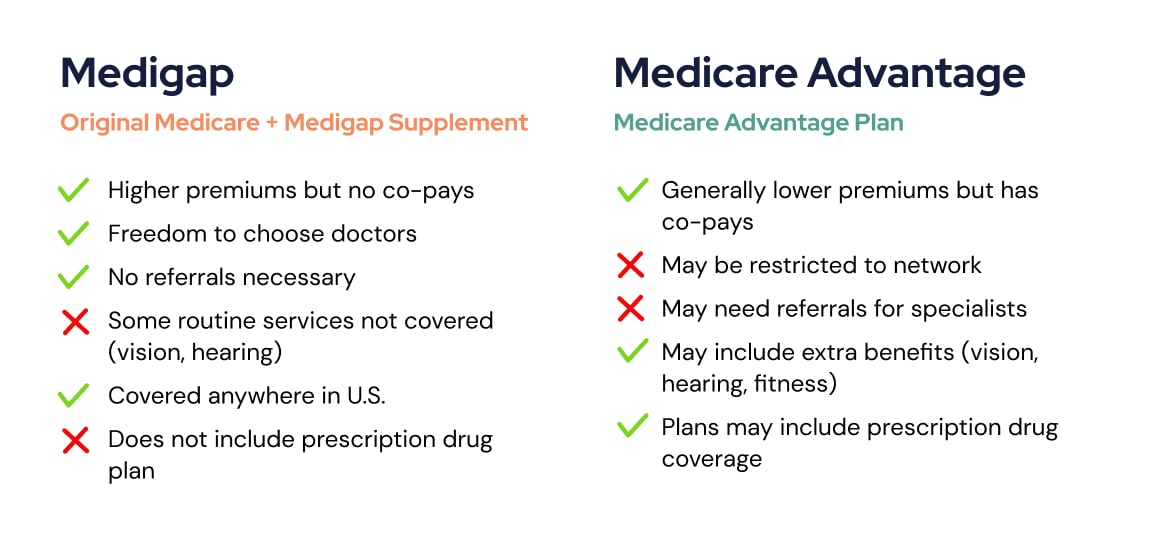

When the law was very first passed, many individuals including the CBO forecasted that Medicare Benefit registration would drop significantly over the coming years as payment decreases forced plans to provide less advantages, greater out-of-pocket expenses, and narrower networks. However that has not held true at all. Medicare Benefit enrollment continues to grow each year.With Original Medicare, you still have deductibles and coinsurance. Medicare Advantage plans normally do not have a medical deductible and have low, set copayments. Numerous Medicare Benefit strategies likewise consist of out-of-pocket limitations on what you will pay each year. The bulk of Medicare Advantage prepares consist of coverage for dental, vision, hearing, and prescription drugs. paul b insurance medicare explained.

There are plans that enable you to include even more oral and vision protection.

The 8-Second Trick For Paul B Insurance Medicare Explained

There are two primary methods to get Medicare coverage: Original Medicare, A Medicare Benefit Plan Original Medicare consists of Part A (health center insurance) and Part B (medical insurance). To help spend for things that aren't covered by Medicare, you can opt to buy additional insurance understood as Medigap (or Medicare Supplement Insurance Coverage).

, which covers all copays and deductibles - paul b insurance medicare explained. If you were eligible for Medicare prior to that time but have not yet enrolled, you still might be able to get Plan F or Strategy C.

If you don't purchase it when you initially end up being eligible for itand are not covered by a drug strategy through work or a spouseyou will be charged a life time penalty if you try to purchase it later on. A Medicare Advantage Plan is meant to be an all-in-one option to Original Medicare.

Not known Facts About Paul B Insurance Medicare Explained

Medicare Advantage Strategies do have a yearly limitation on your out-of-pocket expenses for medical services, called the optimum out-of-pocket (MOOP). Once you reach this limitation, you'll pay absolutely nothing for covered services. Each strategy can have a various limitation, and the limit can alter each year, so that's a factor to think about when acquiring one.

Out-of-pocket costs can rapidly build up over the year if you get sick. "The best candidate for Medicare Advantage is somebody who's healthy," states Mary more helpful hints Ashkar, senior lawyer for the Center for Medicare Advocacy.

However, you might not have the ability to acquire a Medigap policy (if you switch after the previously mentioned 12-month limitation). If you are able to do so, it may cost more than it would have when you first enrolled in Medicare. An employer only requires to supply Medigap insurance coverage if you satisfy specific requirements concerning underwriting (if this is after the 12-month period).

Paul B Insurance Medicare Explained Fundamentals Explained

Be sure to find out if all your physicians accept the plan and that all the medications you take (if it's a plan that also covers in Part D prescription drug coverage) will be covered. If the plan does not cover your current physicians, make sure that its physicians are acceptable to you and are taking brand-new clients covered by the strategy.

Before you register in a Medicare Benefit plan it is necessary to know the following: Do all of your companies (physicians, health centers, etc) accept the plan? You should have both Medicare Components A and B and live in the service location for the plan. You need to stay in the plan until the end of the fiscal year (there are a couple of exceptions to this).

All about Paul B Insurance Medicare Explained

Medicare Advantage prepares, also called Medicare Part C strategies, operate as personal health strategies within the Medicare program, serving as protection alternatives to Initial Medicare. Oftentimes, Medicare Benefit prepares provide more services at a cost that is the same or less expensive than the Original Medicare program. What makes Medicare Benefit plans bad is they have more restrictions than Original Medicare visit this site right here on which medical professionals and medical centers you can utilize.

Most Medicare Benefit plans have their own policy deductible. The strategies start charging copays on the first day of hospitalization.

Getting The Paul B Insurance Medicare Explained To Work

This is particularly good for those who have ongoing medical conditions due to the fact that if you have Parts A and B alone, you won't have a cap important source on your medical spending. Going beyond the network is permitted under many Medicare Advantage preferred service provider strategies, though medical expenses are greater than they are when staying within the strategy network.

Companies should accept the terms of the plan. Providers have the choice of accepting or rejecting care with every check out, creating possible interruptions in care. Emergency care is always covered.: These plans offer advantages and services to recipients with particular requirements or limited earnings, customizing their benefits to meet the needs of particular populations.